Clarity Year-End - 2023

It is that time of the year again to perform our year-end procedures. We have accumulated several documents and resources to assist you in your year-end processing. Please utilize the resources listed below to assist in stepping through the procedures needed to close out your year-end in Accounts Payable, General Ledger, and Payroll.

ACCOUNTS PAYABLE

Documents

Steps Checklist

Utilities

Forms

Videos

GENERAL LEDGER

Documents

Steps Checklist

Videos

PAYROLL

Documents

Steps Checklist

W-2 Form Changes

IMPORTANT: If you ordered blank 4-up W-2 stock

If you chose to utilize the blank 4-up W-2 form, a change is needed on the form before you print your W-2's. We need to change the year from 2021 to 2022. Follow these steps to make that change:

- In Clarity, go to Payroll.

- Click on W-2 and 1099 Reporting.

- Click on Forms.

- Select Form W-2 and click Accept.

- Select the W-2 4-Up Form [Caselle Master] or the W-2 4-Up Form with Instructions [Caselle Master] depending upon which type of form you ordered.

- Click Open.

- There are four (4) instances of 2021 that appear. We need to change each to 2022. Right-click on the first instance of 2021 that you see.

- Click on Settings.

- Change 2021 to 2022.

- Click Accept.

- Repeat steps 7-10 for the other three (3) instances.

- Click the blue Save button on the toolbar.

- Type in a name for the new form (e.g. W-2 4-Up Form).

- Click Save.

INSTRUCTION ON DOWNLOADING AND IMPORTING THE STEPS CHECKLISTS

There are electronic steps checklists available for you to import into Connect to help you through the year-end procedures. To import a checklist, follow these steps:

- Right-click on the appropriate steps checklist (i.e. General Ledger, Accounts Payable, or Payroll).

- Select Save link as or something similar.

- Save the file to a location on your computer or network.

- If the Download complete screen appears, click Close.

- Open the Connect program.

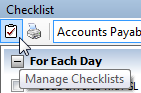

- Move your mouse's arrow to the Checklist on the right side of the screen so that it slides out.

- Click the Manage Checklists button (clipboard with a checkmark).

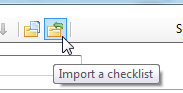

- Click the Import a Checklist button (yellow folder with an arrow going into the folder).

- Navigate to the file saved in step 3 above. Click Open.

- Click on the new checklist that was imported on the left of the screen. You may have to scroll to the bottom.*Note: If there was a year-end checklist that was imported in years past, the new checklist may be named with a number after it (e.g. Payroll Year-end 1)

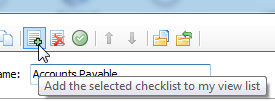

- Click the Add the selected checklist to my view list button (lines on a white paper with a green plus).

- Click OK.

The checklist should now be listed in the drop-down.

Related Articles

Connect Year-End - 2022

It is that time of the year again to perform our year-end procedures. We have accumulated several documents and resources to assist you in your year-end processing. Please utilize the resources listed below to assist in stepping through the ...Connect Year-End - 2023

It is that time of the year again to perform our year-end procedures. We have accumulated several documents and resources to assist you in your year-end processing. Please utilize the resources listed below to assist in stepping through the ...Connect Year-End - 2024

It is that time of the year again to perform our year-end procedures. We have accumulated several documents and resources to assist you in your year-end processing. Please utilize the resources listed below to assist in stepping through the ...Clarity Year-End - 2022

It is that time of the year again to perform our year-end procedures. We have accumulated several documents and resources to assist you in your year-end processing. Please utilize the resources listed below to assist in stepping through the ...Clarity Year-End - 2024

It is that time of the year again to perform our year-end procedures. We have accumulated several documents and resources to assist you in your year-end processing. Please utilize the resources listed below to assist in stepping through the ...